Highlights:

- OpenAI currently depends on Nvidia’s GPUs for model training, a process that demands massive computational power to refine algorithms with large datasets.

- OpenAI isn’t aiming to replace Nvidia GPUs but to develop a specialized chip for inference.

OpenAI is reportedly producing its in-house AI chip to strengthen its position with manufacturers and support data center expansion.

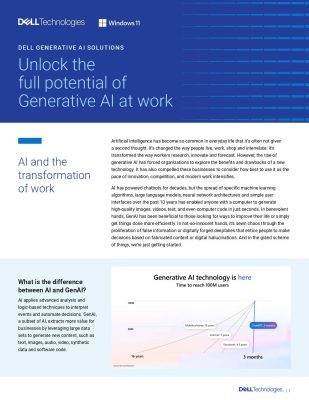

Sources indicate that OpenAI is in the final stages of completing its in-house chip design, with plans to send it for fabrication at Taiwan Semiconductor Manufacturing Co. Ltd. this year. The company aims to begin mass production by 2026.

The specifics of OpenAI’s AI chip design remain unclear, but previous reports, including one from October, suggest the company has been collaborating with Broadcom Inc. and TSMC. Rather than replacing GPUs like those from Nvidia Corp., OpenAI is reportedly focused on developing a specialized chip for inference—the process of using trained models to make real-time predictions and decisions.

As AI adoption grows, specialized chips for inference are becoming essential for handling increasingly complex tasks. OpenAI currently depends on Nvidia’s GPUs for training its models—a process that demands significant computational power to refine algorithms with large datasets. However, inference requires a different type of chip, optimized for speed and energy efficiency rather than sheer processing power.

While the technical concept behind the chip is strong, tech manufacturer politics also appear to be influencing its development. As per sources, the chip “is viewed as a strategic tool to strengthen OpenAI’s negotiating leverage with other chip suppliers.”

Regardless of these strategic motivations, developing the chip will be a costly endeavor for OpenAI. However, for a company where a USD 500 million investment—the estimated design cost—is barely a rounding error, the expense may be manageable. To date, OpenAI has raised USD 17.9 billion, including a record-breaking USD 6.6 billion round in October. Additionally, reports from late January suggest the company is seeking to raise USD 40 billion at a USD 340 billion valuation.